17 May November 2019 – HSA-the Triple Crown of tax-advantaged savings accounts

With a mint julep in hand and donning my one and only fascinator, I watched naively as Justify dominated the Kentucky Derby last year. Little did I know that this horse would go on to win the elusive Triple Crown (controversy notwithstanding). The victory was celebrated with much ceremony, flowers and champagne, and Health Savings Accounts (HSAs) deserve that same fanfare, well perhaps minus the hats and coups. These are powerful savings vehicles, the only such accounts that provide a triple tax advantage. You can contribute pre-tax dollars, the money grows tax-free and withdrawals for qualified health care expenses are also tax-free. With a traditional 401(k)/IRA, you pay Uncle Sam when you withdraw, and with Roth 401(k)/IRA you make after-tax contributions. While HSAs were designed to help people pay for out-of-pocket healthcare costs (those not covered by insurance), you unlock the real value when you leave assets invested in these accounts for decades and amass a significant pool of tax-free funds for your retirement.

Background

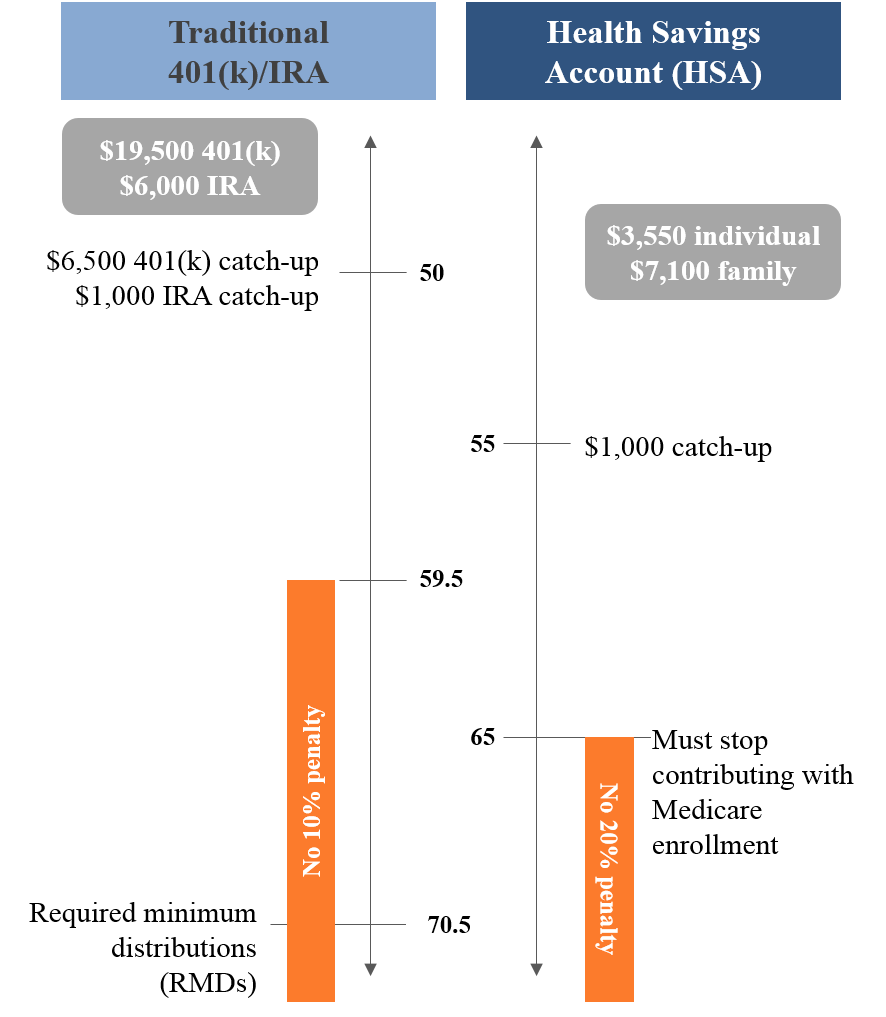

Unlike other tax advantaged savings vehicles, there are no income limits for HSAs; the only qualifying factor is that you are in a high-deductible health insurance plan (defined as a deductible of at least $1,400 for an individual policy and $2,800 for a family policy in 2020). But there are limits to contributions. For 2020, you can contribute $3,550 for an individual and $7,100 for a family; those over the age 55 can contribute an extra $1,000 annually. Funds in your HSA roll over each year (unlike an FSA which must be used within the calendar year), and even if you leave your job you can keep your HSA.

Assets can be withdrawn tax-free as long as they are used to cover healthcare expenses like prescription drugs, doctor’s office visits, laboratory fees, dental treatment, ambulance service, COBRA premiums, long-term care premiums, etc. If you pay your medical expenses out of pocket instead of withdrawing the money from your HSA, you can reimburse yourself anytime in the future. If you do withdraw for non-medical expenses and you are under 65, you will pay income tax and a 20% penalty; if you are over 65, you just pay the income tax (no penalty) for non-medical expenses, so at this point, these function much like a traditional 401(k)/IRA.

Strategies for maximizing your HSA

Emergency fund: These accounts can be used as a triple tax-advantaged emergency fund. For example, your family has had a many normal years of health expenses for regular doctor’s visits and prescriptions. During those years, you paid the doctor and pharmacy directly and chose to not reimburse yourself from your HSA. At the start of year ten, you have a financial need arise. At that point you can reimburse yourself for those prior year out-of-pocket expenses. Be sure to keep track of medical receipts.

Gifting: If your adult child is covered under your high-deductible health insurance and does not qualify as a tax dependent (children are dependents under age 19 if not a student and under age 24 if enrolled in college), the child can establish an individual HSA and you can contribute to it as a gift. Your child does not need to have earned income. Once your child leaves your insurance plan (they can stay on until age 26), the child can keep the account for future medical expenses or as a savings tool for retirement

Qualified HSA Funding Distribution (QHFD): Under current tax law, you have the right to make a one-time penalty- and tax-free rollover of funds from your IRA to an HSA. The maximum amount you can rollover is the same as the annual contribution limits. This technique is particularly useful if you have a large medical expense and are considering using IRA funds to pay for this expense. If you withdraw from your IRA before age 59.5, you will pay income tax and a penalty. However, if you roll the funds from your IRA to your HSA, you can use that money for your medical expenses without tax or penalty.

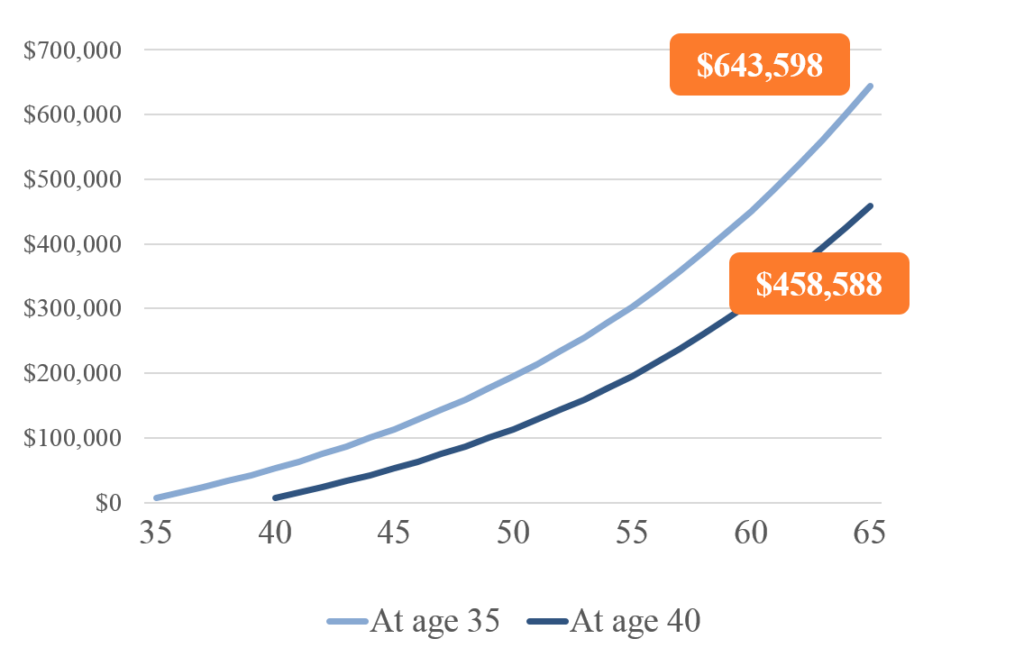

Long-term savings: You can accumulate significant savings in your HSA. If a 40-year-old contributes the maximum allowable family amount per year ($7,100 in 2020 and growing the contribution limit at 1.5% annually) for 25 years, leaves the money undisturbed and invests in a mix of assets returning 5%, he or she would build up about $450,000 by age 65.

According to the Fidelity Retiree Health Care Cost Estimate1, the average 65-year-old couple retiring this year, may need approximately $285,000 saved (after tax) to cover health care expenses in retirement, excluding long-term care. Genworth’s Cost of Care Survey 2 estimates long-term care inflation at 3%, above the general economy-wide inflation of approximately 2%, and the average one-year stay in a private nursing home room at $100,375.

The assets you accumulate in your HSA can go a long way towards funding your retirement health care expenses and/or long-term care expenses (or long-term care insurance premiums) in a triple tax efficient manner.

Words of caution

Open enrollment periods vary, but, for the most part, they are open now until early December (check your employer or marketplace for specific dates), so this decision is imminent. However, the coverage under the high-deductible, HSA-eligible plans may not suffice for every family’s needs. Also, note that once you begin Medicare, you are not eligible to save into an HSA.

HSAs do have some costs, namely investment fees and maintenance charges. These vary by custodian. Before opening an HSA account, review the fees. Contributing to your company’s HSA allows you to enjoy the convenience of automatic pre-tax paycheck withdrawal. However, if your company’s HSA is high-cost, you can regularly roll over the HSA assets into a lower-cost plan of your choosing.

When it comes to estate planning, naming your spouse as the beneficiary on your HSA means all the same rules carryforward with the account. However, if you name a non-spouse beneficiary, the fair market value of the HSA on the date of death becomes taxable income for your heir. If you expect to have a balance remaining in your HSA account for a non-spouse beneficiary, consider the following:

- The beneficiary can use the HSA balance to pay for outstanding medical expenses for the HSA account holder, effectively lowering the balance the beneficiary inherits. This is optimal when the beneficiary is also the heir to the remainder of the deceased’s estate.

- Name your favorite cause as beneficiary and leave other assets to loved ones. The nonprofit will receive the balance of the HSA tax-free.

Final thought

As always, your specific goals and circumstances will determine the best mix of savings vehicles for your overall financial plan. That said, I encourage you to reach for the Triple Crown and consider optimizing your HSA today. And if possible, invest your HSA assets and wait until retirement to make withdrawals; this could help you feel more secure about your physical and financial future.

Julie Zawislak