19 May May 2020 – Into the Great(?) Reopen

As we transition into reopening our communities, the stock market has cheered and risen significantly off the lows of late March. This dramatic reversal was driven by a quick and massive policy response followed by optimism about the economic recovery.

Covid-19 caused the entire global economy to come to a halt, and the complex gears of the economic system are not designed to pause. In March many investors were fearing the next Great Depression as the full extent of the economic lock down became clearer, and in response a massive wave of monetary and fiscal support were unleashed to combat a gigantic economic contraction. On the monetary side, the Federal Reserve dropped its policy rate from 1.5% to 0%, began large-scale asset purchases, initiated new lending programs, and took other steps to ensure the plumbing of the financial system continued to operate. Fiscal support included enhanced unemployment benefits, direct payments to households, and loans/grants to small businesses. Other global central banks and governments throughout the world enacted similar responses. These responses removed or at least significantly decreased the probability of a worst case scenario in the minds of investors, which at least for the time being placed a floor under the markets. Markets then began to focus on the reopening process and positive medical developments towards treatments and eventually vaccines for the virus.

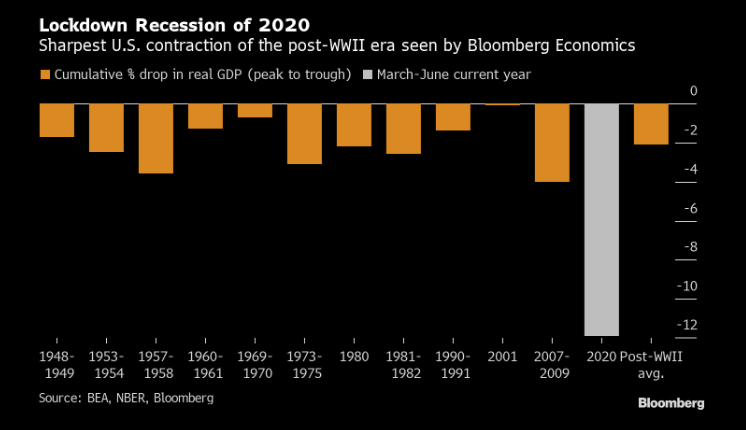

It is admittedly a dissonant feeling for markets to march upward during a time of terrible economic data. We are in the midst of the most severe contraction in the post WWII era, and the data is staggering.

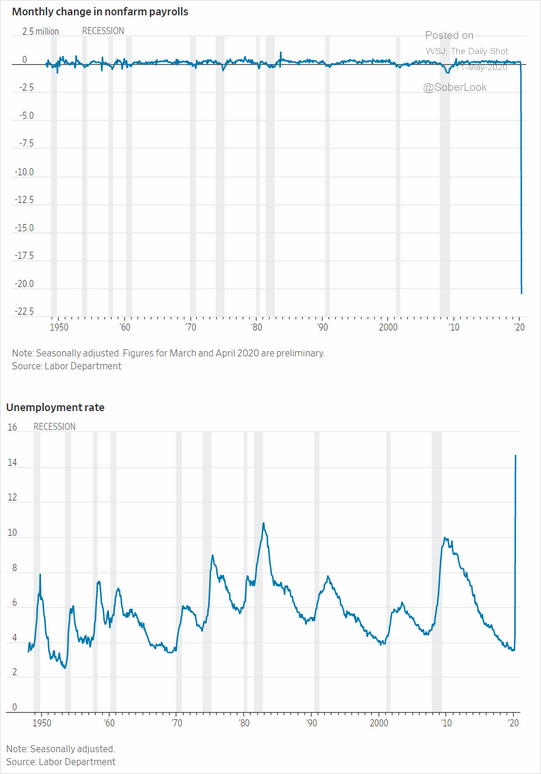

The next two charts show the historic impact on labor markets and the changes in comparison to the last 70 years are so drastic they seem unbelievable.

As we look forward towards an economic recovery, economists like to use the alphabet to describe the shape of the recovery: will it be V-shaped, U, W, L? I think the best description of the recovery, and one that is gaining traction with an increasing number of economists, is that the recovery will look more like a Nike “Swoosh”. This can be thought of as a sharp drop followed by a slow and gradual recovery. One addition I would make to the idea of the swoosh is that the recovery or right-hand side of the swoosh is likely to be jagged and uneven. The virus is endemic in our population and unlikely to just disappear. I think the base case scenario is that as communities open back up, virus transmission will increase. Whether this takes place this summer or there is a delay until the fall is anyone’s guess, but we should expect more cases as human interaction increases. The likely increase in virus transmission will cause some retrenchment in activity and be a driving force behind the slow and uneven recovery.

The economy will likely be subdued and operate below full capacity until the development of a vaccine. Over 100 vaccines are in development globally and at least eight have started testing in humans, according to the Wall Street Journal. Unfortunately most vaccines in development will fail and the timeline until one is approved is uncertain. The most aggressive timelines include emergency approval with limited distribution this fall followed by wider distribution in early 2021. Countless scenarios push this timeline back, and there are many questions regarding how effective the vaccine will be. In the meantime, the longer uncertainty hangs over business and individual decisions, the worse for the macroeconomic environment. Uncertain businesses will cut back on investment to preserve cash, but this has a negative effect on innovation. Many employees of uncertain businesses will be concerned about future employment and will increase savings, negatively impacting economic growth. Also, 88% of Americans that lost their jobs in April reported that their layoffs are temporary. Extended economic stagnation can cause temporary layoffs to become more permanent, potentially eroding workers’ skills. Lastly, as the economy operates below capacity for longer periods of time, the risk of liquidity issues becoming solvency issues increases for both businesses and individuals. Decreasing the level of uncertainty in a timely manner is clearly crucial.

During this time of uncertainty strong businesses will likely come out stronger and gain market share as weaker competitors struggle or fail. We believe it is critical to own a portfolio of companies that will not only survive the current environment, but thrive on the other side of our current challenges. We also believe it is critical to remain balanced during the ups and downs that will likely be in our near future. On that note, we have used the recent rally in equity markets to increase cash across our investment portfolios which allows us to be more opportunistic during future bumps in the road.

Tom Searson, CFA