08 May January 2016 – When Will Markets Improve?

When Will Markets Improve?

When will the stock market stop declining? How much worse will it get? These are common questions anxious investors ask me during headline-grabbing stock market declines like the ones we’ve experienced recently.

Correction – 10% + Decline From Peak

Noting the differences between a market correction and a bear market is important during stock market declines as we strive to better understand the current and future investment landscape. “Corrections” are classified as more than a 10% decline from the peak and are fairly common occurrences. We experienced a correction in late summer of 2015 and we are currently in the midst of one again in January 2016.

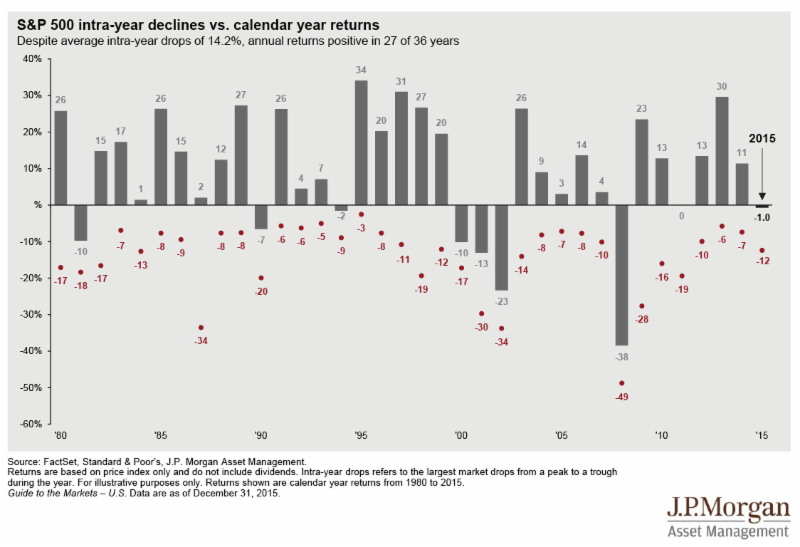

Prior to summer 2015, the S&P 500 had gone without a correction since October of 2011. This nearly four-year stretch was much longer than the historical average of experiencing a correction about every 18 months over the last six decades. The average intra-year drop since 1980 has been 14.2%, yet the market produced a positive return in 27 of those 36 years – and has even generated annual returns of greater than 20% in several years that included a correction.

Annual Returns and Intra-Year Declines

Bear Market – 20% + Decline From Peak

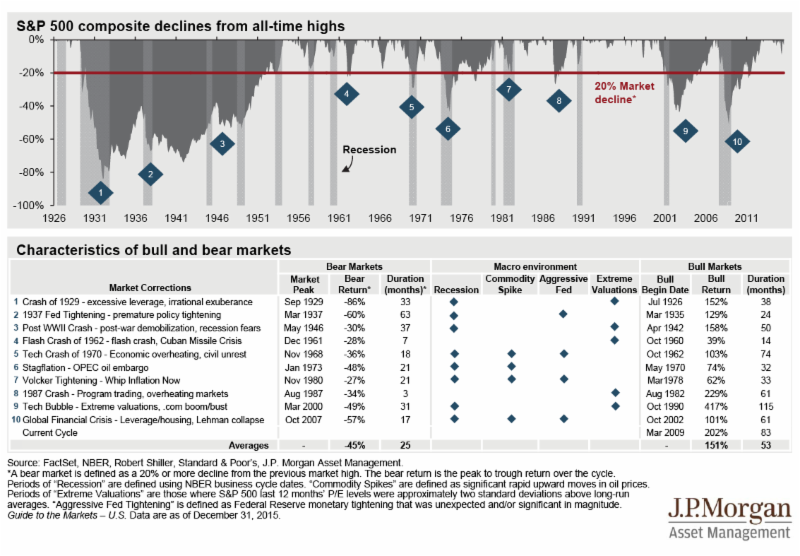

Bear markets, those with a more than 20% decline from the peak, are less common, occurring about once a decade since the inception of the S&P 500 in the mid-1920s. In fact, recessions historically happen more often than bear markets.

Every bear market has included at least one of four themes, serving as a catalyst for market declines; almost all have involved at least two:

- US Recession

- Commodity Price Spike

- Aggressive Fed Tightening

- Extreme Valuations

None of these four themes are present today. The absence of these themes alone doesn’t eliminate the possibility of a bear market and we know eventually there will be another bear market – perhaps one that presents a new theme or catalyst for decline that we have not seen before. And, one of these themes could still emerge during this downturn. The probability of us experiencing a bear market in the next decade is more likely than not. However, in addition to the history of bear markets outlined in the chart below, we should note the subsequent bull market rallies (defined as gains of at least 20% from market bottoms). Per the data below, historically, bull markets have lasted much longer and the gains have been much greater.

Bear Markets and Subsequent Bull Runs

Market Recovery

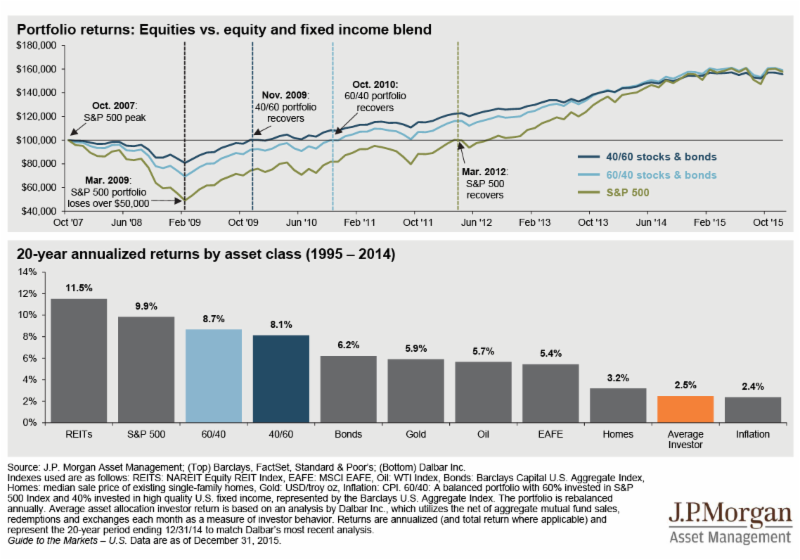

Most people already know and understand the premise that markets have historically recovered and gone on to set new highs; however, this understanding tends to provide less comfort as people reach a stage in life when they depend on their assets, rather than earned income, for living expenses. In that light, the chart below illustrates what is typically a positive surprise for people who are concerned about whether they have the time to wait for a recovery.

Diversification and the Average Investor

Even during the recent “Great Recession” investors who didn’t sell in a panic saw their portfolios recover fairly quickly. In fact, people who invested in the S&P 500 at the peak of the market in October 2007 would actually still be up 23% after January 9, 2016 even if they spent all dividends on living expenses rather than reinvesting those dividends. Investors fortunate enough to be able to reinvest dividends would be up closer to 50%.

Answering Investors’ Questions

So, when will it stop and how much worse will it get? Investors’ fears are driven by the undeniable fact that nobody truly knows. However, a recession is unlikely as long as we remain in an environment with job growth, low energy costs, muted inflation and low interest rates.

Given these factors and considering that investor sentiment during this recovery from the last recession has been more cautious than euphoric, keeping valuations in check, I do not believe we are entering the next bear market yet. However, if I’m wrong, my experience and an overwhelming amount of research confirms that investors who sell when they are fearful in hopes to buy back at lower prices are very unlikely to time those decisions to produce a financially beneficial outcome. Investors who remain invested in an asset allocation appropriate for their circumstances have been rewarded for their fortitude and patience during difficult times.

I’ll close by saying that while we believe staying the course is the best path for investors, we are not suggesting that our strategy is to “hold and hope.” Opportunities are created when the market is being driven by fear or greed with a larger percentage of investors than normal making decisions based on emotion. We remain actively looking for and executing on these opportunities to improve our clients’ portfolios. Level-headed portfolio managers and financial advisors can take advantage of securities being offered below where thoughtful analysis indicates they should be priced.

While it is impossible to know all of the answers, I firmly believe we are making decisions that will prove to add value during this challenging time for investors.

Brian Jones, CFP