17 May December 2019 – 2020 Vision

The United States economy continues to extend the current expansion, which is already the longest in our history. Unemployment is historically low, matching the lowest level since 1969. In addition, wages continue to expand at a solid clip, providing the backdrop for a strong consumer. Despite some notable challenges, global growth has been above 3% for 10 consecutive years, the longest streak since the 1960s.

As we look into 2020, most investors predict continued steady growth, low inflation, and low unemployment. Common consensus is that this economic backdrop will result in positive stock market returns, albeit significantly less than the returns this year. Most stock strategists are predicting mid to high-single digit returns. While I can see this return profile as a likely outcome as well, I am a little more cautious than the average strategist.

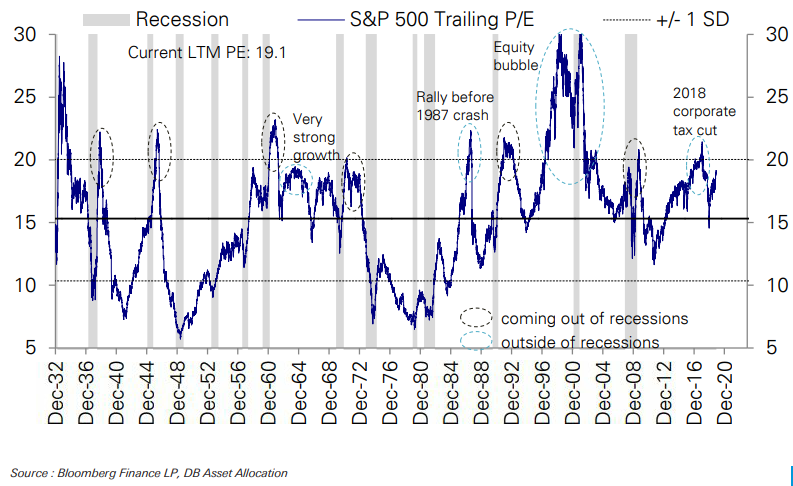

One method to assess the valuation of a company is to use the P/E multiple, which is the multiple investors place on the earnings of a company to arrive at a stock price. This method can then be extrapolated to a group of stocks as a proxy for the market as a whole. In the case of the chart below, this group is the S&P 500. The current P/E multiple of the S&P 500 is 19.1, which as you can see in the chart, is not cheap, but not excessive in comparison to history.

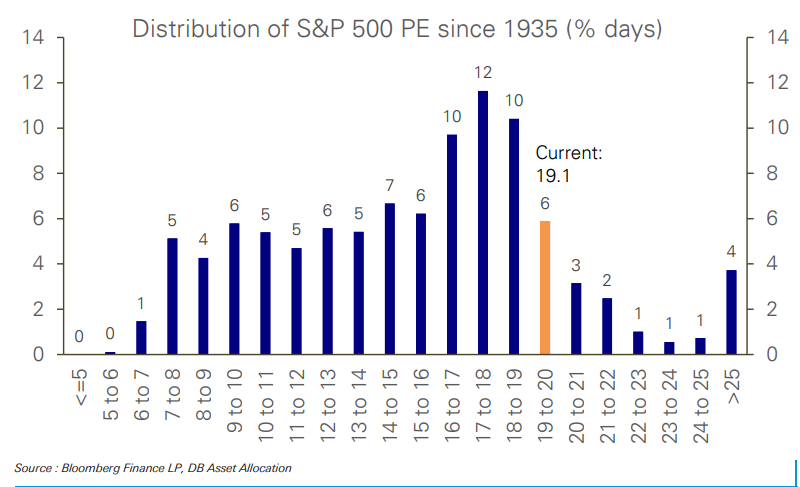

Another way to look at the same data shows the number of days the S&P 500 has traded at each multiple over the last 85 years. Again, you can see the current multiple skews towards the expensive end of the spectrum, but is not at extreme levels.

The current valuation on the stock market signals that investors have strong confidence in the most likely 2020 scenario of steady growth and low inflation. As I mentioned earlier, put me in this same camp as well, but add a little more caution for potentially increasing volatility.

The first variable that could cause increased volatility is ongoing trade disputes. Last Friday the US and China announced what is being called a “Phase I” deal. While details are scarce at this time, this announcement does, for the time being, remove some downside risks in the market. Unfortunately next level negotiations will become increasingly complex, and news flow from negotiations may cause volatility. A Deutche Bank macro strategist summed up the complexity with a simple question in a research report, “In the coming decade will China’s military operate on US software, and will the US’s military operate on ‘made in China’ hardware?” The worst of the trade rhetoric between China and the US may be on pause until the election next November, but substantial progress towards further agreements will be increasingly difficult to achieve.

Speaking of the upcoming election, the outcome of the 2020 election, and its impact on the markets and economy will be hotly debated over the next 10 to 11 months. Election news is likely to cause market volatility, especially in the short term. While elections are certainly important, our economy is bigger than any one election cycle. We will all hear predictions of economic and market collapse if (insert candidate here) wins. Pundits pounded the table in 2016 that the stock market would crash and the world would plunge into recession if Donald Trump were elected president. We heard the same dire warnings in 2012 if President Obama were to be re-elected. Here we are about to close out 2019, and the longest economic expansion in the history of the country continues to chug along. So as everyone hears dire predictions from Armageddonists heading into next year’s election, please keep the following chart in mind:

This chart shows the opportunity loss of shifting out of stocks after a pundit’s Armageddon forecast. There will absolutely be more recessions, more bear markets, and likely more market crashes. But no one can predict them with accuracy, and listening to those that try can lead to a large opportunity loss.

Our long economic expansion is likely to continue, however stocks are not cheap, and trade and election noise may cause increased volatility. We have accumulated cash across our investment portfolios, ready to deploy when volatility returns. Volatility often presents compelling investment opportunities, and we will have the dry powder to act.

From everyone at Providence Capital Advisors – We wish you a happy Holiday season and a prosperous New Year!

Tom Searson, CFA