19 May February 2021 – The Pets.com sock puppet posts on Reddit

Pets.com remains one of the symbols of the late 1990s technology bubble, largely due to its marketing campaign. The pets.com sock puppet was everywhere, including an interview on Good Morning America, a 2000 Super Bowl advertisement, and even as a balloon in the 1999 Macy’s Thanksgiving Day Parade. The lovable puppet came to mind last week as the Gamestop/Reddit mania gripped the markets.

Let’s start with a little background for those that were lucky enough not to get swept into the news cycle regarding Gamestop. Gamestop is a retail store that sells video games and consoles. Many hedge funds believe the company could be the next Blockbuster Video, and placed trades to bet that Gamestop’s stock price would go down. One popular version of this trade is called a short sale or being “short” a stock. From a mechanical standpoint, an investor that wants to short a stock borrows the stock and then sells it. The idea is to buy the stock back at a lower price and return the borrowed shares. Now enter an online forum on Reddit called wallstreetbets to the story. In this forum, discussions swirled around the upside in Gamestop if hedge funds had to “cover” their short positions. Shorting stocks can be a risky proposition because it involves leverage. If a shorted stock increases in value, the lender of the shares may require more capital. This can cause hedge funds to be forced to buy back the stock to close out their trade, pushing the stock price higher. This scenario becomes a self-perpetuating cycle known as a “short-squeeze” causing the stock price to increase substantially. Episodes of short squeezes have been occurring for over 100 years.

Gamestop stock hovered around $4 – $5 most of last year before ending the year around $19. At one point last week the stock hit an astounding $483 for a year to date return of over 2,400%. The mania spread to other highly shorted stocks such as AMC Theaters. The creator of the wallstreetbets forum admitted he created it as a form of gambling, not investing. Although in this case there were some fundamental investment tenets at the beginning, once we reach the mania phase, it’s basically taking your money to Vegas and spinning a roulette wheel. So how does this frenzy impact the rest of the market and are we in a bubble?

Although highly-shorted stocks subject to this type of manipulation are a tiny subset of the overall stock market, the impact can expand beyond this small circle. Melvin Capital Management, which was heavily exposed to short positions in Gamestop, lost 53% in January. While few will likely shed tears for a hedge fund that started the year with over $12 billion in assets, they, and other funds with losses must sell other holdings to raise cash to cover their short positions. Some of the first sale candidates are often the large, liquid companies where cash can be raised quickly, causing some volatility in the market as a whole. Volatility is an inherent component of investing, and last week’s events are yet another source of that volatility.

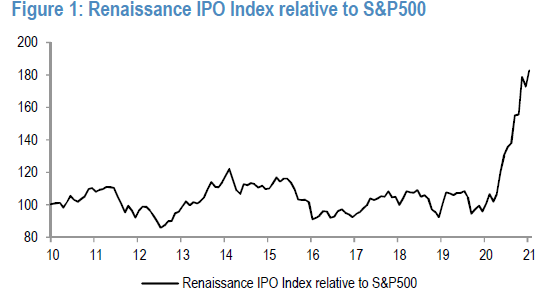

I do believe there are pockets of bubbles in the financial markets, and some areas are reminiscent of the late 1990s tech bubble. 2020 was the largest year for IPOs (initial public offerings) since the tech bubble, and the performance of newly public companies has been extremely strong.

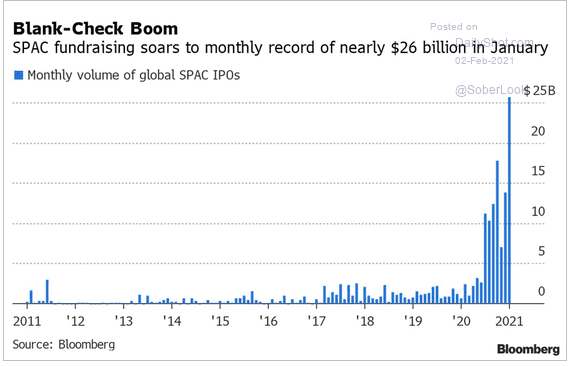

Special Purpose Acquisition Companies (SPACs) are another hot area that is cause for concern. SPACs are essentially blank check companies that are formed to raise money in order to buy a private company at some time in the future, essentially taking it public overnight without much of the regulatory heavy lifting of a normal IPO process. More money was raised in SPACs in 2020 than the previous 11 years combined, and then after this big year, fundraising exploded in January.

And lastly, I throw the hotly debated Bitcoin into the mix:

While I do think there are pockets of bubble-esque excesses, I think these segments are relatively small, and for the moment, contained. As mentioned earlier, these segments will have some effect on the overall market, but I believe they are short-term mechanical issues, not long-term fundamental issues.

Comparing the current environment to the tech boom of the late 1990s is understandable in some respects, but valuations are still cheaper than those days. For example, Microsoft was the largest stock in the S&P 500 and trading at 56x earnings in March 2000. Today it is the second largest stock in the index and trading at 33x earnings. I’m not claiming that 33x earnings is cheap, but it is not near the levels of the tech boom. The other largest stocks in March 2000 were Cisco Systems trading at 126x earnings, General Electric at 40x, and Intel at 43x. In comparison today we have Apple at 30x, Google at 36x, and Facebook at 23x. Amazon, the 3rd largest company in the S&P 500 is trading at 94x. My point is not that any of these stocks are cheap investments at these levels, rather that there is a notable difference between now and the tech boom.

Furthermore, and importantly, interest rates are very different now than in the tech bubble. The 10-year U.S. Treasury bond yield was above 6% in early 2000 compared to about 1% today. Valuations in investing are relative, not solely absolute, and the current low interest rate environment should and does equate to higher equity valuations.

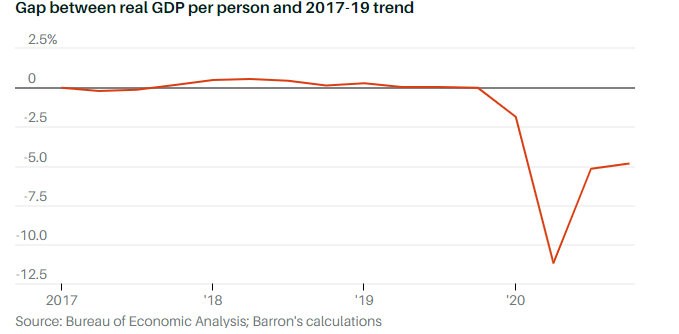

Rather than focus on the unknowable short-term movements related to Gamestop and other bubbly market segments, we focus on what is likely to drive the economy and markets over the next few years. At the top of the list is an economic rebound as we move past the COVID pandemic. According to The Bureau of Economic Analysis and Barron’s, the economy is running at about 95% of what it would be had there been no pandemic.

In a sense, we are now in a race between vaccine distribution and virus mutations. This race may lead to short-term volatility in the financial markets, but economies are likely to open and rebound as a greater percentage of the population, and particularly those that are more at risk for serious complications, get vaccinated. As we reach this point, pent-up demand will likely be released driven by the fact that the US personal savings rate is about double the historic norm.

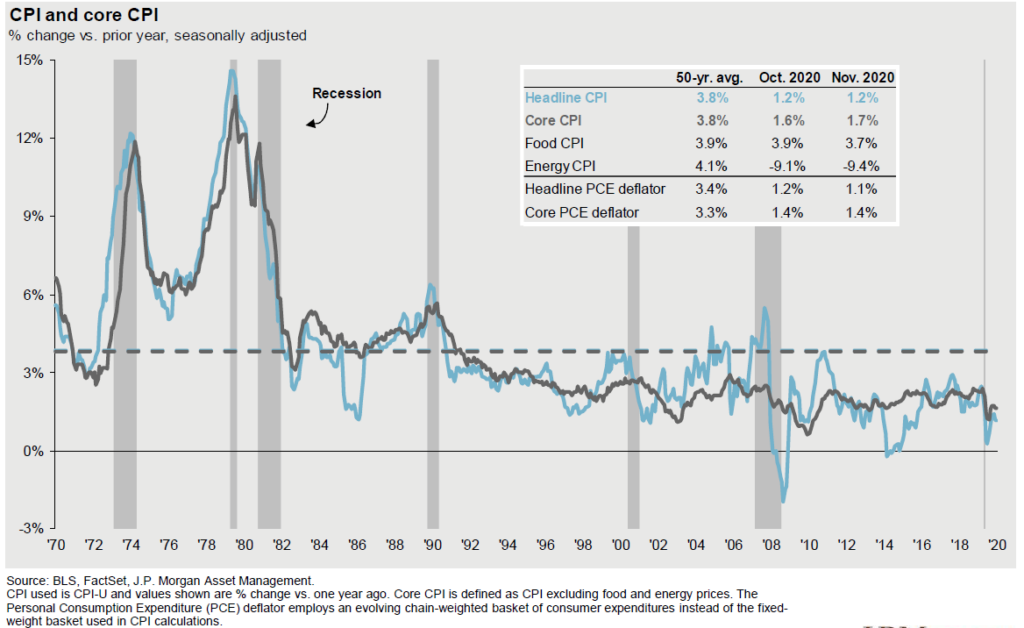

The other large variable, in my opinion, is interest rates. Earlier I listed the price to earnings multiples for the 5 largest stocks in the S&P 500. Each of these companies is likely to experience strong growth in the future, thereby potentially validating current valuation. However, current valuations are not likely sustainable in a higher interest rate environment. The two biggest influences over interest rates in the coming years will likely be the Federal Reserve and inflation. The Fed is unlikely to push rates higher until we see full employment and/or inflation. As you can see in the chart below, inflation has been low and controlled for about 30 years.

At this time there is enough slack in the economy that I don’t feel inflation is a risk in 2021, however it will be important to monitor over the next few years.

2021 has the potential to be a volatile year in the markets, but we are positioned and ready to manage through any volatility. Circling back to Gamestop, the online chatrooms may be calling attention to some potential bubbles, but for now, they appear to be small and isolated, and therefore limited to short-term effects.

Tom Searson, CFA