19 May March 2020 – Corona wakes the bear

The longest bull market in U.S. history ended last week as fears tied to the spread of the coronavirus (COVID-19) caused historic volatility in financial markets. This newsletter will attempt to share some thoughts on the global pandemic’s impact on the economy, financial markets, and investment portfolios, but at its core the biggest impact is on our collective health. Economies and financial markets will recover, but tragically many individuals will not. In times like these we must hope that people in every community will look beyond self-protection and help those most in need.

Our lives will be placed on hold in the near term as activity grinds to a halt. The goal of cancelling group gatherings and minimizing close interactions is, as many of you likely know, to ‘flatten the curve’. If this virus spreads quickly throughout our country, we do not have the hospital beds, medical staff, or equipment such as ventilators to handle the surge in cases. If, on the other hand, we can slow the spread by minimizing contact, we can widen out the upcoming cases and allow those that need care to receive it.

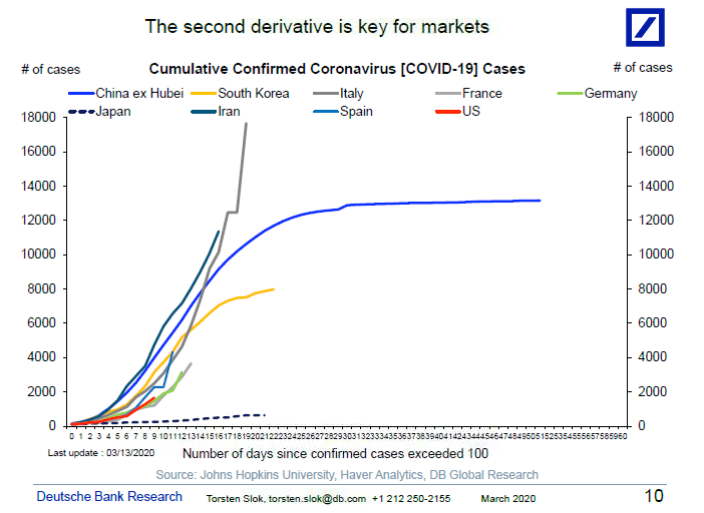

Halting activity provides the best opportunity to flatten the curve, but it will have significant economic impact. Companies will lay off workers, lower capital expenditures, and some will have trouble servicing debts. No one can say for certain how far this virus will spread or what the ultimate economic impact will be. We can, however, look to data from other countries for clues. The chart below shows the cumulative number of cases in highly-affected countries.

The most encouraging aspect of this chart is new cases in China, where the virus first spread to humans, has fallen close to zero. Some may push back that data from the Chinese government is notoriously unreliable, but two data points give me comfort that at a minimum the trajectory of data from China is accurate. The first is South Korea where their data is following China’s. In fact, over the last few days the number of patients released from hospitals in South Korea is greater than the number of new cases. The second data point comes from Apple. Apple announced on Friday that they were reopening all of their retail stores in China after being closed for approximately one month. This announcement was followed shortly by news that Apple would close all global retail stores outside of China. The company would not make these decisions without seeing significant improvements in the environment in China.

The most discouraging aspect of this chart is Italy, which is why the country resorted to a nation-wide lockdown. Actions currently taken by our communities and organizations in the United States are an attempt to follow the trajectories of China and South Korea and not Italy.

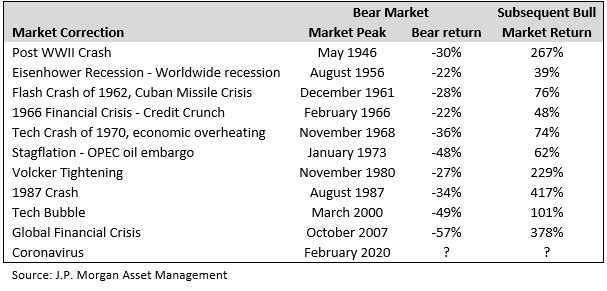

The financial press is beginning to focus on the possibility of a recession either globally, domestically, or both. In my opinion whether we fall into recession, which is defined as two consecutive quarters of negative economic growth, is irrelevant. It is irrelevant because whether we trigger this technical definition or not, it will feel like we are in a recession in the near term, and the economic data will be recession-like. First quarter data will be slower than expected, but may still be positive. Second quarter data will be terrible, an outcome already expected by investors. The key will be growth beyond this initial shock. How quickly can we move beyond the current crisis, and how much pent-up demand will fuel second-half growth? These questions are key for the financial markets. The second reason I believe the technical trigger of recession is irrelevant is that the S&P 500 has already declined about 30% peak to trough, near the average and mean of prior stock markets declines during recessions.

Panic and fear are driving the financial markets, which typically provides opportunities for long-term investors. As we have mentioned before, we have cash available to invest across our investment portfolios. Unfortunately there is never an all clear signal given on the best time to invest the cash. We therefore have been slowly investing cash, and opportunistically picking up what we believe are good long-term opportunities, while holding back some cash in case more opportunities present themselves. Two weeks ago we sent out a table showing returns after event-driven market declines. Now that we have entered a bear market we wanted to share the table below which helps reinforce the importance of staying the course and sticking to the long-term investment plan during difficult times.

At this time the highest likelihood outcome appears to be that we get to the other side of this global pandemic in a reasonable time period, economies recover, and markets finish the year higher than they are now, but even in this base case scenario stock markets can certainly go lower in the near term. We also must acknowledge that there are downside risks to this base case driven by a longer duration of the pandemic.

It is almost certain that the number of cases in the United States will ramp exponentially over the next few weeks as the virus spreads and testing increases. This will lead to an increase in negative news flow, and as discussed earlier, bad economic data. Volatility will likely remain high and wild swings in the market do not change the likelihood of us moving beyond the pandemic and into an economic recovery. As we look for new investment opportunities and continuously challenge our current investments, our focus will be on high quality companies with strong balance sheets that can navigate through this halt in economic activity. The duration and economic impact of this current challenge are frustratingly elusive, but humankind has faced challenges throughout our history and we will rise up to this challenge just as we have countless others.

Tom Searson, CFA